For example California uses Schedule X. In Malaysia corporations are subject to corporate income tax real property gains tax goods and services tax GST.

Important Things In Your Payslips Need To Check Payroll Template National Insurance Number Payroll Software

The FPX Financial Process Exchange gateway allows you to pay your income tax online in Malaysia.

. For example the basis period for the YA 2021 for a company which closes its accounts on 30 June 2021 is the. First late penalty 10. You can make things right by filing an amended tax return using Form 1040-X.

Tax Saving - Know about how to income tax saving for FY 2022-23Best tax saving tips options available to individuals and HUFs in India are under Section 80C. Some states allow you to e-file amended returns while others require that you file a paper return. The United States has income tax treaties with a number of foreign countries.

For example if someone is in the highest tax slab 309 one gets a tax return amounting to 1128 saving a huge amount. Under these treaties residents not necessarily citizens of foreign countries may be eligible to be taxed at a reduced rate or exempt from US. Balance of tax not paid after April 30.

Tax Identification Number - TIN. Social Security Numbers SSNs are. One thing worth mentioning is Malaysia has an extensive number of double tax treaties available for the avoidance of Double Taxation.

Get an insight on the basics about the income tax act 1961 heads of incomes slab rates income tax returns form 16 residential status and corporate tax. For example the basis period for YA 2017 for a business that. What if youve sent in your income tax return and then discover you made a mistake.

Internal Revenue Service IRS. 10 of the income tax where the aggregate income is between Rs. Here are the many ways you can pay for your personal income tax in Malaysia.

15 of the income tax where the aggregate income is beyond Rs. Also use the X suffix for the form number. Income between INR 3 lakhs-INR 5 lakhs.

Unique 12-digit number issued to Malaysian citizens and permanent residents and is used by the IRBM to identify its taxpayers. A tax identification number TIN is a nine-digit number used as a tracking number by the US. Section II TIN Structures 1 ITN The ITN consist of maximum twelve or thirteen alphanumeric character with a combination of the Type of File Number and the Income Tax Number.

Income taxes on certain items of income they receive from sources within the United States. Income more than 10 lakhs. Most income tax treaties contain what is known as a saving clause which prevents a citizen or resident of the United States from using the provisions of a tax treaty in order to.

For example the year starting from 1st April 2018 and ending on 31st March 2019 is the assessment year 2018-19 the previous year would be 2017-18. Employees Withholding Certificate. 50 lakhs and Rs.

Request for Taxpayer Identification Number TIN and Certification Form 4506-T. Income between INR 5 lakhs-10 lakhs. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope.

As we have discussed what taxes. Income tax numberEmployer number. Request for Transcript of Tax Return Form W-4.

The Income-tax Act of India has a number of sections. Income Tax Reliefs for Tax Residents in Singapore either local or foreign tax-resident. 1 Pay income tax via FPX Services.

Income up to INR 3 lakhs No tax. Even though the progressive rates for personal income tax rates range from zero to 22 percent in Singapore the effective payable tax may come out to be much lower if one takes advantage of the various schemes the Singapore Government has initiated.

Building Contractor Appointment Letter How To Create A Building Contractor Appointment Letter Download This Building C Lettering Letter Templates Templates

.png)

How To Check Your Income Tax Number

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Taxable Income Formula Calculator Examples With Excel Template

Malaysia Sst Sales And Service Tax A Complete Guide

Form 1116 Step By Step Guide To Claim The Foreign Tax Credit

Sample Cover Letter For Japan Visa Applicants No Itr In 2022 Writing A Cover Letter Cover Letter Application Cover Letter

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Malaysia Personal Income Tax Guide 2021 Ya 2020

Investing Investment Property Goods And Service Tax

Service Contract Offer Letter How To Draft A Service Contract Offer Letter Download This Service Contract Letter Example Lettering Download Letter Templates

How To Sell Online Payslips To Your Employees Payroll Payroll Template National Insurance Number

Bbva Bank Statement Template Mbcvirtual Statement Template Bank Statement Templates

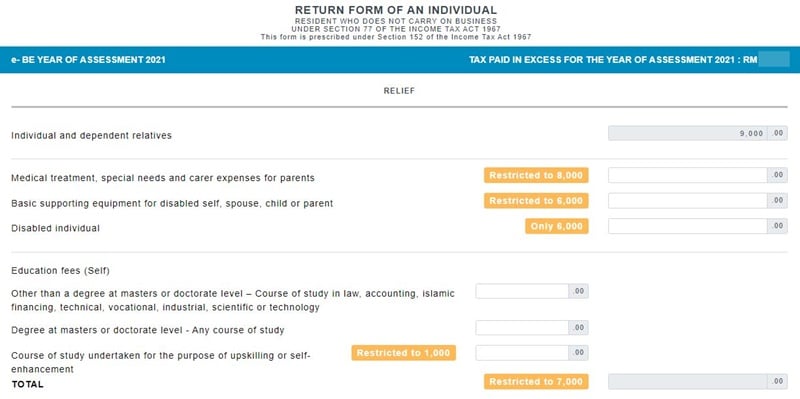

Malaysia Personal Income Tax Guide 2022 Ya 2021

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

25 Great Pay Stub Paycheck Stub Templates Excel Templates Payroll Template Templates

How To Create A Free Payslip Template In Excel Pdf Word Format How To Wiki Payroll Template Receipt Template Templates